oklahoma franchise tax online filing

All Major Categories Covered. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

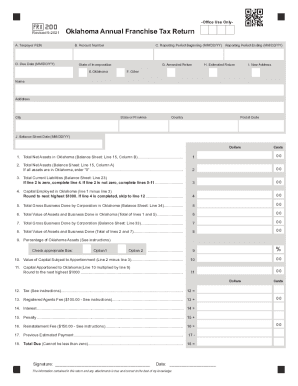

You can change your filing date by filing Form 200-F Request to Change Franchise Tax Filing Period by mail or online using OkTAP Oklahomas online filing system by July 1st.

. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. You will be automatically redirected to the home page or you may click below to return immediately. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825.

Enter your username and password. Our Mission is to serve the people of Oklahoma by promoting tax compliance through quality service and fair. Form 200 - Page 5.

The following is the Tax Commissions mission statement as it exemplifies our direction and focus. After you have filed the request to change your filing period you will not need to file this form again. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

These elections must be made by July 1. Determine the amount of franchise tax due. Select Popular Legal Forms Packages of Any Category.

Tax year the tax will be due and. Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. Franchise Tax Computation The basis for computing Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of the last preceding.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Allocated or employed in Oklahoma. On the Oklahoma Tax Commission website go to the Business Forms page.

Once completed you can sign your fillable form or send for signing. You can file earlier to get a refund sooner if applicable. Visit us at wwwtaxokgov to file your Franchise Tax Return Officer Listings Balance Sheets and Franchise Election Form Form 200-F.

You can create an account by clicking Register here To file your Annual Franchise Tax by Mail. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S.

This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to. On the Oklahoma Tax Commission website go to the Business Forms page. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

All forms are printable and downloadable. Go to the Oklahoma Taxpayer Access Point OkTAP login page. Scroll down the page until you find Oklahoma Annual Franchise.

To register as a new OkTAP user click the Register Now button on the top right of the OkTAP homepage and complete the required fields. All Major Categories Covered. Your session has expired.

Form 200-F must be filed no later than July 1. To file your Annual Franchise Tax Online. You will need to specify one tax account type for OkTAP access at the time of registration.

You may file this form online or download it at wwwtaxokgov. You can change your filing date by filing Form 200-F Request to Change Franchise Tax Filing Period by mail or online using OkTAP Oklahomas online filing system by July 1st. Department of the Treasury.

Online Filing - Individuals Use Tax - Individual E-File Income CARS Sales Use Rate Locator Payment Options Tax Professionals. Form 200-F must be filed no later than July 1. Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free.

Oklahoma Annual Franchise Tax Return State of Oklahoma On average this form takes 62 minutes to complete. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now.

You may file this form online or download it at taxokgov. Complete OTC Form 200-F. If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete Franchise Election Form 200-F.

To file your Annual Franchise Tax Online. Access can be added to additional accounts through OkTAP after you have registered. Franchise Tax Computation The basis for computing Oklahoma Franchise Tax is the balance.

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

2022 Tax Day Is April 18 Abc10 Com

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates Thompson Greenspon Cpa

Fill Free Fillable 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State Of Oklahoma Pdf Form

What Is Franchise Tax Legalzoom Com

Liberty Tax Review 2022 How Much Does It Cost And Is It Right For You Financebuzz

Get And Sign Income And Franchise Tax Forms And Instructions Oklahoma 2021 2022

2022 Tax Day Is April 18 Abc10 Com

Is A Covid 19 Tax Loss A Qualified Disaster Loss Cherry Bekaert

How To File Your Delaware Franchise Tax On Time Pilot Blog

Things To Consider When Using A Symbol Or Punctuation In A Legal Business Name Harvard Business Services

Hart Tackle Co A Local In Nw Arkansas Manufacturer Of Fishing Tackle Currently Makes Jigs Spinner Bait Buzz Bait And Spinner Bait Bass Fishing Lures Grubs

Complete And E File 2021 2022 Oklahoma Income State Taxes

Incorporating In Delaware Advantages And Disadvantages Legalzoom Com

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

4 Types Of Entrepreneurship Tips For Women In Business

Are My Business Tax Returns Public Advice For Small Businesses